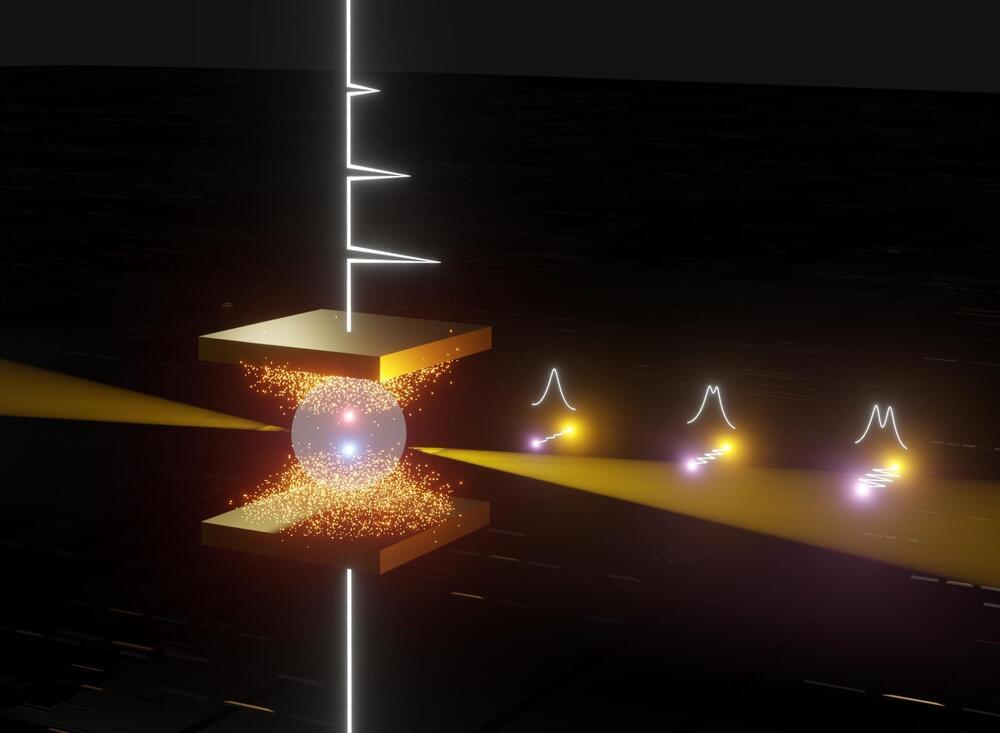

In a breakthrough that could help revolutionize wireless communication, researchers unveiled a novel method for manipulating terahertz waves, allowing them to curve around obstacles instead of being blocked by them.

While cellular networks and Wi-Fi systems are more advanced than ever, they are also quickly reaching their bandwidth limits. Scientists know that in the near future they’ll need to transition to much higher communication frequencies than what current systems rely on, but before that can happen there are a number of — quite literal — obstacles standing in the way.

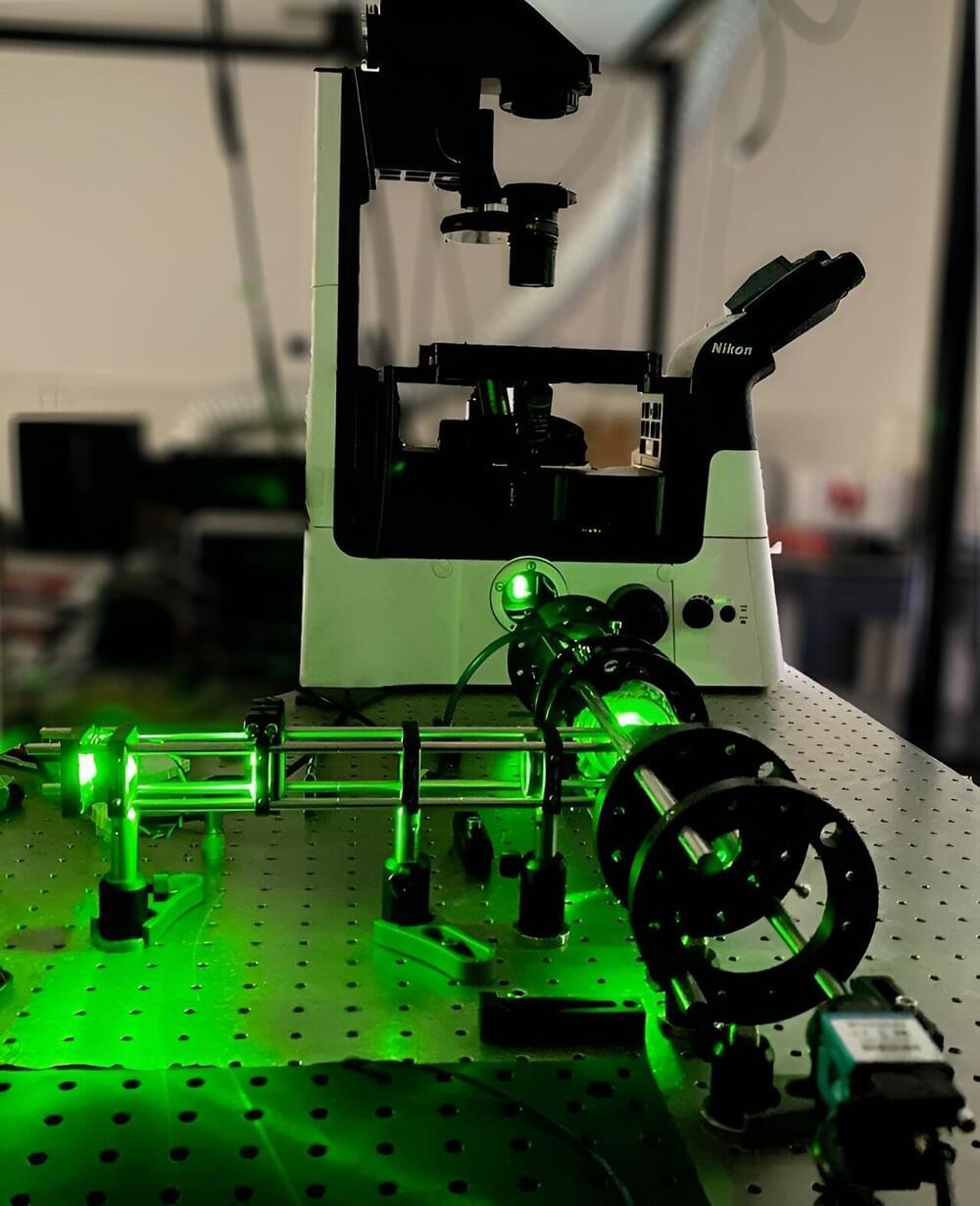

Researchers from Brown University and Rice University say they’ve advanced one step closer to getting around these solid obstacles, like walls, furniture, and even people — and they do it by curving light.