Oct 31, 2016

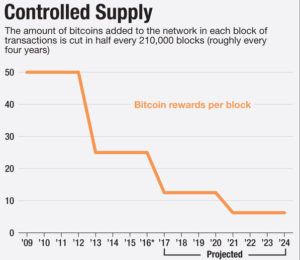

Diminishing Bitcoin Mining Rewards

Posted by Philip Raymond in categories: bitcoin, cryptocurrencies, economics, internet, privacy

By now, most Bitcoin and Blockchain enthusiasts are aware of four looming issues that threaten the conversion of Bitcoin from an instrument of academics, criminal activity, and closed circle communities into a broader instrument that is fungible, private, stable, ubiquitous and recognized as a currency—and not just an investment unit or a transaction instrument.

These are the elephants in the room:

- Unleashing high-volume and speedy transactions

- Governance and the concentration of mining influence among pools, geography or special interests

- Privacy & Anonymity

- Dwindling mining incentives (and the eventual end of mining). Bitcoin’s design eventually drops financial incentives for transaction validation. What then?

As an Op-Ed pundit, I value original content. But the article, below, on Bitcoin fungibility, and this one on the post-incentive era, are a well-deserved nod to inspired thinking by other writers on issues that loom over the cryptocurrency community.

As an Op-Ed pundit, I value original content. But the article, below, on Bitcoin fungibility, and this one on the post-incentive era, are a well-deserved nod to inspired thinking by other writers on issues that loom over the cryptocurrency community.

This article at Coinidol comes from an unlikely source: Jacob Okonya is a graduate student in Uganda. He is highly articulate, has a keen sense of market economics and the evolution of technology adoption. He is also a quick study and a budding columnist.

excellent, quick & brief overview.

excellent, quick & brief overview.